How to Prepare for a Successful Move to Denver: a Step-by-Step Guide

Moving to a new city can be both exciting and overwhelming. Denver, known for its vibrant culture, stunning natural beauty, and thriving job market, is

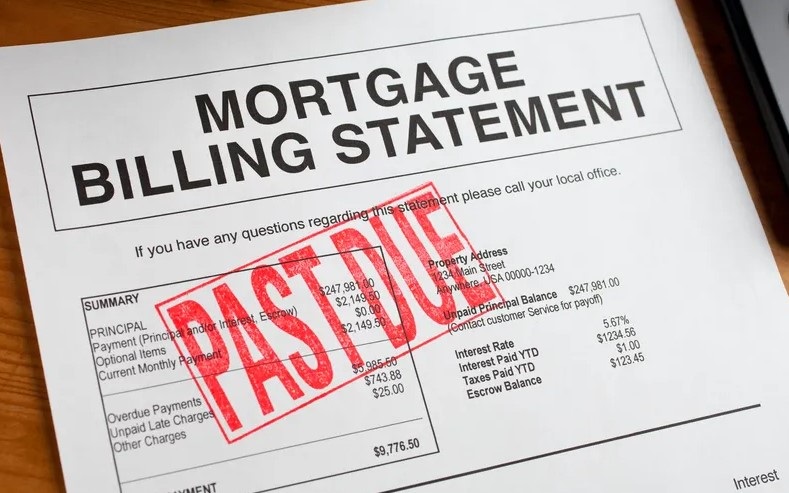

If you are facing financial hardship and, as a result, you cannot pay your mortgage, you can sell the house before foreclosure.

The procedure depends on the house’s value and if it is enough to settle your mortgage balance. It also depends on whether you have already been issued a foreclosure notice.

Either way, you have to settle all your mortgage arrears to be able to transfer the title deed to the home buyer. You may also want to consider options such as loan modification and forbearance instead of selling the house.

Typically, mortgage servicers stipulate that you make monthly payments towards the principal amount, interest rates, and other mortgage fees.

A majority give a 15-day grace period for making your monthly mortgage payments. You incur a late fee penalty if you have not made your payment by the 15th of the next month.

Suppose you are still unable to make payment in 30 days. In that case, your mortgage lender may invoke the “accelerating the debt” clause requiring you to immediately pay the remaining mortgage loan amount.

Failure to which the house goes through foreclosure. In most states, you have defaulted on your mortgage payment for at least 120 days for the foreclosure process to be initiated.

Aside from losing the house, foreclosure leads to a bad credit score making it more difficult to borrow. And, if you find a lender, they will likely offer a higher interest rate. Therefore, it is best to sell your house before it goes into foreclosure.

That way, you have control over the sale process, you protect your credit score, and if the house has gained equity and value, you get to pocket the net proceeds.

Below are the options for selling your house if you can’t pay the mortgage.

If you haven’t defaulted or missed only one or two payments, you can immediately put up the house for sale. Either hire a real estate agent to oversee the sale process or put up the house as For Sale By Owner (FSBO). Both options involve the following steps:

You do not have to involve the loan servicer unless you already have a foreclosure notice. If you anticipate that you will not have completed the sale by the time of foreclosure, involve the mortgage company early on in the sale process so that you can negotiate for a time extension.

Otherwise, go through with the sale process and involve the lender at closing when paying off the mortgage balance to enable you to transfer the title to the homebuyer.

A short sale is most suitable if the house has negative equity. Its value is much lower than the loan balance. The lender has to approve a short sale. They will assess to establish that a short sale is the best option. They may sue you to pay the outstanding balance.

However, you may appeal for the balance to be forgiven, in which case it will be treated as taxable income by the IRS.

Selling to a cash buyer is the fastest way to sell your house, whether it has positive or negative equity. It is viable for different types of sales, including FSBO, traditional sale, foreclosure, bankruptcy sale, auction, etc.

Find a reputable cash buyer in your area—they are usually real estate investors and flippers. Most have a website you can look through to understand how their sale process works. Also, check their reviews to establish their credibility. Then contact prospective ones to get an offer.

The cash buyer will make a preliminary offer depending on the listing details. They will then schedule a walk-through of the house and make a solid offer. Negotiate their offer to reach an agreement and proceed with closing the sale.

Generally, selling to a cash buyer takes a shorter time than a traditional sale. If you sell your house fast for cash in Denver, it is straightforward, and you can do it yourself without hiring a real estate agent. However, it is a good idea to involve a title company or escrow to oversee the transfer of funds and a closing attorney to oversee the closing.

If you’re in the area, check out WeBuyHousesInDenver.org to get a cash offer. As we say, we buy houses for cash near me.

If you do not want to sell despite being unable to pay your mortgage, here are some alternatives to consider.

If you can get a mortgage lender with a lower interest rate, consider applying for refinancing. If you qualify, your new lender pays off our current mortgage. You also get a chance to restructure your monthly mortgage repayments and the repayment period, making it more affordable and manageable for you.

To be eligible for refinancing, you must have a high credit score. As such, you want to start the refinancing procedure before defaulting on your existing mortgage payments, or as soon as you notice, you may not be able to keep up with them.

If your home equity has increased, you may consider cash-out refinancing. Also, check if you qualify for VA loans or FHA loans.

An alternative for a cash-out refinancing would be to get a home equity loan or home equity line of credit (HELOCs). Whereby you take a second loan against your home equity.

For a home equity loan, you will be awarded a lump sum that you can use to pay off your mortgage debt or offset the missed payments. With HELOCs, you are offered revolving credit that you can use to keep up with your monthly mortgage payments.

A loan modification allows you to permanently or temporarily change the repayment terms. However, modification may hurt your credit. It could also lead to increased interest rates and overall mortgage debt. Discuss with your mortgage lender the loan modifications they can offer you and whether there are penalties or additional costs.

The bank reduces your monthly payments or allows you not to make payments temporarily. Mortgage forbearance is most suitable if you are experiencing temporary financial struggles and expect to bounce back soon.

With a deed in lieu of foreclosure, you voluntarily hand over the title deed of the house to the lender instead of going through a foreclosure process or a short sale. This option is more favorable for your credit score than a foreclosure or short sale.

You can access a new loan after four years or two years for VA loans. In comparison, you would have to wait for 7-14 years to qualify for another home loan after a foreclosure. And even then, it may be difficult to find a lender.

Can you sell a house if you haven’t paid off your mortgage?

You can sell a house if there is still a mortgage on it. In fact, because many people move every 5 to 7 years it is more common than not to sell a house while there is still a loan on it.

THIS IS WHAT HAPPENS TO THE MORTGAGE: When you sell your house the title company will use some of the money from the sale to pay off the mortgage. It really is that simple so if you have a mortgage on your house and you want to sell it it’s ok.

Can you freeze your mortgage while selling your house?

Typically no, but if this is a must then you should reach out to your lender to see if they will help you out in some form.

What happens if I stop paying the mortgage?

If you stop paying the mortgage you will get behind on payments and ultimately this will end up as a foreclosure with the bank selling your house at auction.

Before it goes to auction the bank will start applying late fees. This will increase the amount you owe the bank. The bank will also charge additional legal fees and processing fees.

In short, if you stop paying your mortgage while you are selling your house the balance of your loan will go up significantly because of late fees, penalties, and administrative costs, charged to you by your lender.

As long as the house is sold for more than the loan balance, including the additional charges, you will not owe the bank anything. However, if you can make the payments it would be a good idea because then you will walk away with more cash when you sell.

Can I transfer my mortgage to another property?

Generally, a bank will not allow you to transfer your mortgage to another property. However, if this is something you would like to try and do, it never hurts to ask.

If you have a mortgage, always do your best to make your monthly repayments on time. However, if you are facing financial hardship and cannot keep up with the mortgage payments, there are some options to consider.

See if you qualify for refinancing or discuss with your lender about a loan modification. If these options are unsuitable for you, consider selling the house.

Assess the house’s equity and establish the best approach to sell. If it has gained equity and you have not yet been issued a foreclosure notice, put the house on sale immediately.

Either list as FSBO or through a real estate agent. If it has negative equity, seek approval from your lender to proceed with a short sale. Whatever the circumstance, selling to a cash buyer is the fastest option.

Contact us for a cash offer on your house in Denver.

USEFUL RESOURCES:

Can I Sell My House Before Paying Off the Mortgage?

If I Can’t Pay Mortgage, Can I Sell My House?

How to Sell a House With a Second Mortgage In Colorado

Can I Sell My House on Land Contract With a Mortgage?

Can You Sell a House With a Reverse Mortgage?

Can I Sell My House If I Have a Reverse Mortgage?

Can I Sell My House If Im Behind on Payments

Moving to a new city can be both exciting and overwhelming. Denver, known for its vibrant culture, stunning natural beauty, and thriving job market, is

Value add in real estate means finding ways to make a property more valuable. This can include things like renovating, improving operations, or changing how

Colorado Springs is a great location for rental property owners, but even in high-demand rental markets, selling your rental property sometimes makes financial sense. The

We’re a service-focused, home buyer that specializes in helping homeowners get rid of burdensome houses quickly. We are Colorado cash buyers who can buy your house fast with a fair all-cash offer. Imagine an instant online quote to sell as-is, without realtors and on your timeline! As a house buyer that’s what we offer. Therefore, if you need to sell your house fast and need a trusted professional home buying company look no further because we buy houses fast for cash.

We Buy Houses In Denver, 1337 Delaware St, Denver, CO 80204